This website use cookies to ensure you get the best experience on our website

Retirement Tax Control

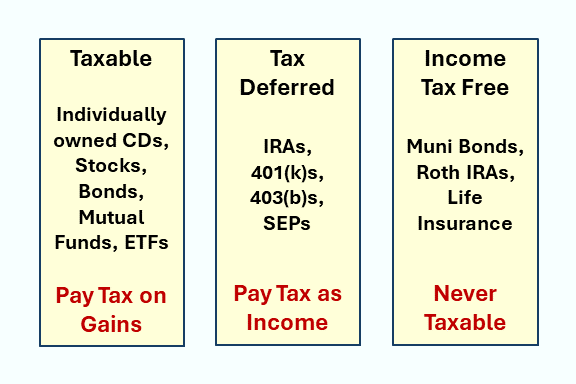

Common practice is to focus on receiving as big a tax deduction as possible, without consideration for the taxes when you have to take the money out or sell an asset.

Unfortunately, most people have their retirement money tied up in savings plans at work and IRAs, and most business owners have their expected retirement money locked up in their business.

And, few people have a strategy in place to access those funds in a tax-efficient manner.

You see, there's an elephant in the room ... The fact that every tax payer will pay more in 2026, as many of the federal tax laws are set to expire at the end of 2025. Congress might just let it happen as a way to raise taxes without doing anything further.

That's why it's essential to prepare as soon as possible for the time you start taking money out of your accounts or sell your business.

Wouldn't it make sense to develop a strategy to smooth out or eliminate your income taxes at some point?

Depending on your current situation, PlanPrep may be able to show you how many hundreds of thousands you may be able to save in income and estate taxes for you and your loved ones by taking advantage of time and using the right asset locations.

Our strategies are 100% within the tax code and have been used by many of our successful clients for years and have met with their tax advisor's approval. You will like our strategies, too.

Click HERE to pick a good time to chat with us. It costs nothing to talk.

Ready to navigate your retirement journey with our expert guidance?

We are not tax advisors. We work in conjunction with you and your tax advisor

to help you make the best decision for your situation and needs.

Note that we don't show details of our strategies on this website, as we don't want to educate our competition.